I’m 42 this month. I got my Student Loan in 2001 when I first went to university; I took £3k per year for 3 years and have managed to pay it off over 22 years!

As a director, I take a minimal salary and dividends so don’t make student loans payments via payroll each month. It is calculated annually as part of my self-assessment tax return.

I’ve mentioned this in previous articles and it’s a real issue for me: HMRC IS NOT LINKED UP WITH THE STUDENT LOANS COMPANY FOR THIS CALCULATION. Here’s the proof in photo form….

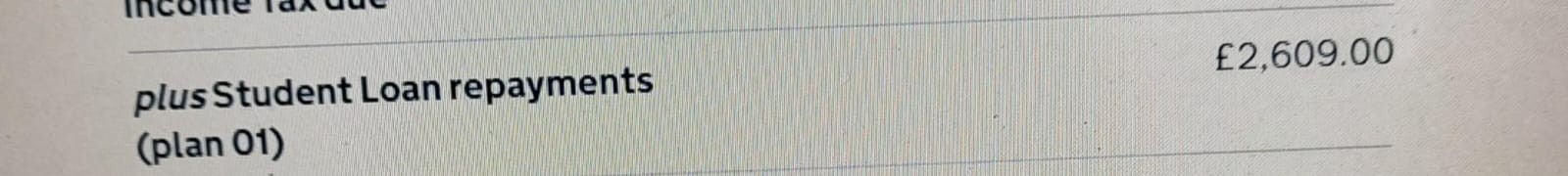

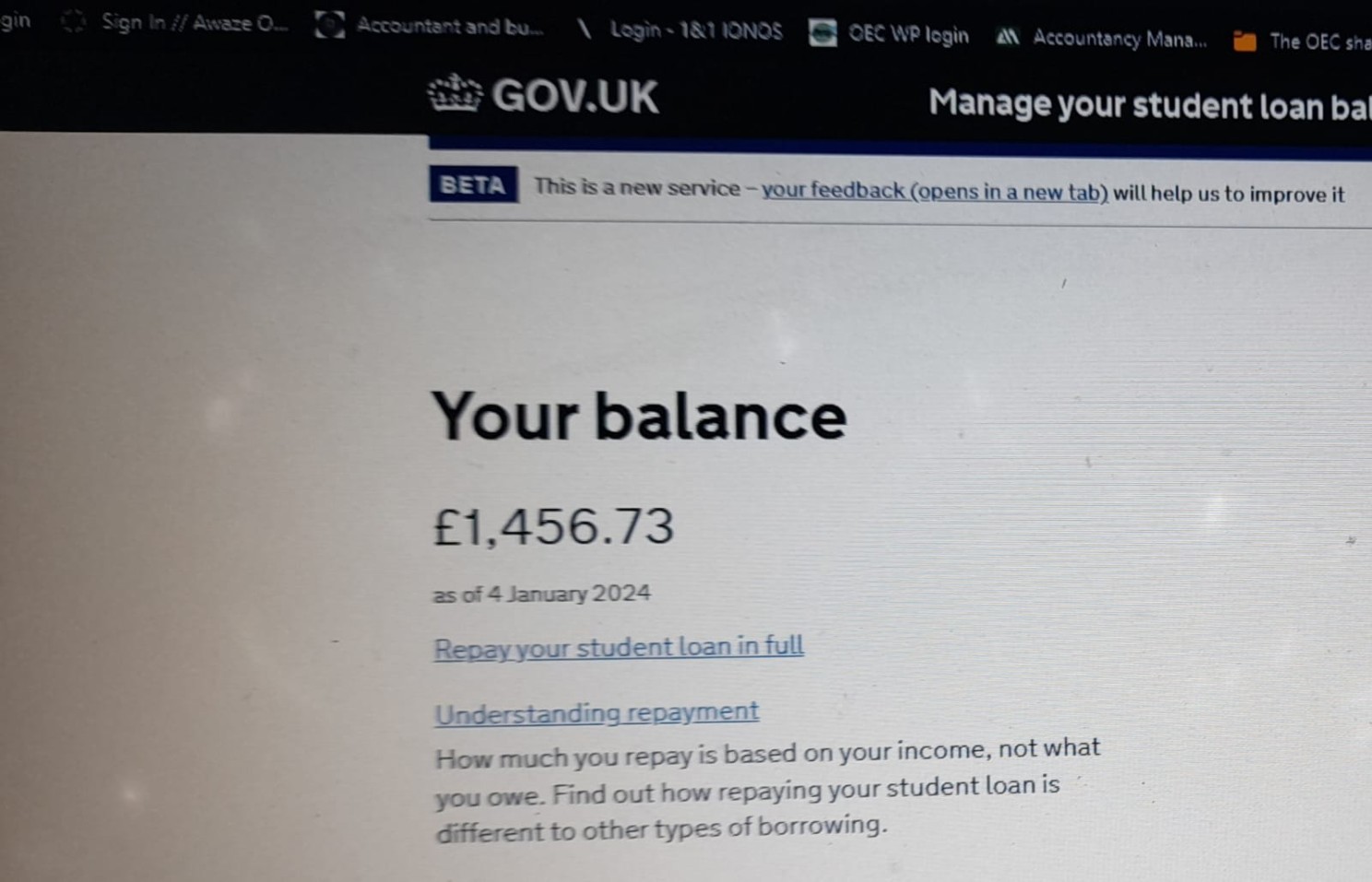

Self Assessment says I owe £2,609. When I signed in to my Student Loans Company account (see my previous article on how to do this, even if you don’t know your CRN number) the balance remaining was £1,456.

Now if I didn’t know that HMRC IS NOT LINKED UP WITH SLC FOR THIS CALCULATION I would have paid that amount and then had to claim the £1,000+ back from SLC at a later date, once I realised. Because, guess what? They don’t let you know!

The moral of this story is that you need to know your own finances and don’t rely on government organisations to tell you these things!

Oh, and maybe get an accountant like me to help you understand the system and save you £1,000s each year😉. Get in touch here to be added to the 2024 waiting list https://carolineboardmanconsulting.co.uk/contact-us/